Many investors are worried about how the intense price war may squeeze out of Rackspace and was unconvinced about the OpenStack technology, a main value driver for Rackspace. But after the Q2 2014 Results on May 12, 2014, it has shown that the revenue has reaccelerated. According to the recent released report dated May 15, 2014 by Morgan Stanley, the analysts said that Rackspace had a market capitalization of about $4 billion and was the largest company in terms of acquisitions when comparing to SoftLayer, SAVVIS and Terremark, but has the cheapest stock price when valued by EV/EBITDA. Rackspace was trading at a multiple of 6.1 times 2015 estimated EV / EBITDA, and the average multiple "on an LTM EV / EBITDA pre-synergies basis" for the three deals is 15.7 times.

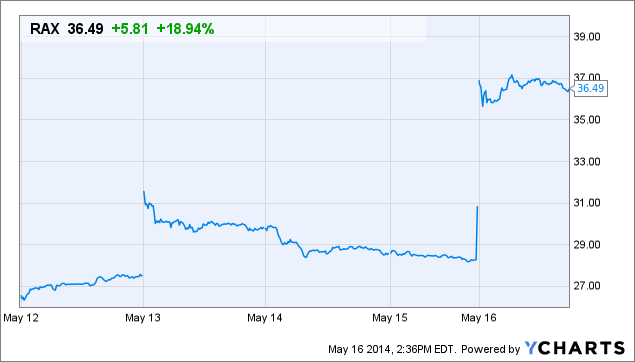

From my previous article, Rackspace: Beyond The Price War, published on May 1, 2014 before the Q2 2012 Results, I have described how I identified values for the company and its future outlook despite numerous articles discussed about losing confidence in it. I think the values that I see are something more tangible than the short-lived stock price. The share price has soared over 30% since Monday. It looks dramatic, but I think this is just beginning since the price was already undervalued even when its quarterly earnings beat expectations. I think the current price is a reflection of fear, not by its performance or value.

From my previous article, Rackspace: Beyond The Price War, published on May 1, 2014 before the Q2 2012 Results, I have described how I identified values for the company and its future outlook despite numerous articles discussed about losing confidence in it. I think the values that I see are something more tangible than the short-lived stock price. The share price has soared over 30% since Monday. It looks dramatic, but I think this is just beginning since the price was already undervalued even when its quarterly earnings beat expectations. I think the current price is a reflection of fear, not by its performance or value.

RSS Feed

RSS Feed