​Are you ready for another biggest offering of stock since last year's China's Alibaba Group?

According to IFR, a Thomson Reuters publication, messaging app LINE, which is owned by South Korea's largest web portal operator, Naver Corp, plans an initial public offering of up to $3 billion in New York and Tokyo Exchange at the same time.

According to IFR, a Thomson Reuters publication, messaging app LINE, which is owned by South Korea's largest web portal operator, Naver Corp, plans an initial public offering of up to $3 billion in New York and Tokyo Exchange at the same time.

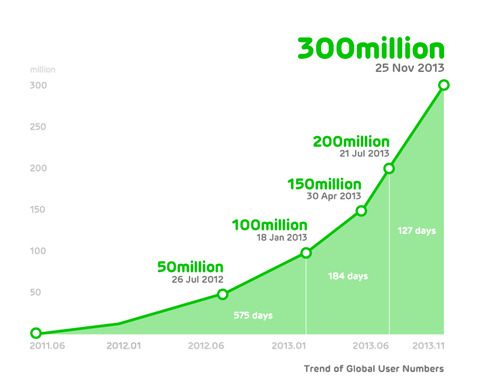

So how popular is LINE?

There is no doubt that LINE is very popular among Asian countries, includes Japan, Taiwan and Thailand. But how popular is popular for LINE? Well, I believe if you shut down LINE service for just one day, the whole country like Taiwan won't function normally at all, and that also includes its local elected officials. Many local officials have created different groups so they can effectively communicate and work. Since 2013, LINE has made a big push break the US market, and it has gained substantial momentum in its marketing campaign.

LINE has been monetizing its virtual "stickers" which users can send instead of emoji to each other, and those stickers cannot be copied and pasted, so it must be purchased. According to The Wall Street Journal, LINE gained $323 million in 2013. The company even opened up a brick-and-mortar “Line Friends Store†in central Tokyo where users can purchase physical versions of the official seals they send digitally. In Taiwan, many stores carry Line Friends merchandise.

The road to IPO was delayed for years since LINE decided the timing was not right. In August of 2015, Naver's CFO Hwang In-Joon said that the company would put off the IPO of Line until its earnings and market conditions improved.

Another possible reason for delaying an IPO was whether or not to list together in the U.S. and Japan at the same time, according to the Nikkei. I think with the high growth of the business and the growing interests among the retail, LINE feels more comfortable doing an IPO this year before the end of summer. We'll see how it turns out.

The road to IPO was delayed for years since LINE decided the timing was not right. In August of 2015, Naver's CFO Hwang In-Joon said that the company would put off the IPO of Line until its earnings and market conditions improved.

Another possible reason for delaying an IPO was whether or not to list together in the U.S. and Japan at the same time, according to the Nikkei. I think with the high growth of the business and the growing interests among the retail, LINE feels more comfortable doing an IPO this year before the end of summer. We'll see how it turns out.

RSS Feed

RSS Feed